Segmenting Spend Portfolio Into Categories/Commodities

Segmenting Spend Portfolio Into Categories/Commodities

Any good procurement or supply chain manager wants to maximize profitability and lower costs. But to do this, they need to gather data and understand the value of segmenting and controlling their spend portfolio (i.e. how and where they spend money for necessary organization purchases of goods or commodities).

Direct spend portfolio analysis, segmentation, and control involve categorizing main commodities like:

raw materials

off-the-shelf components

custom-made components

external manufacturing

Another type of classification can be:

Mechanical

Electrical

Electrical Mechanical (EM)

Packaging

They can be further broken down into sub-categories.

But why is this kind of categorization important for organizations? How segmenting the spend portfolio into distinct and understandable categories or commodity types can provide great value to an organization?

This article will help supply chain managers to get an overview of the large number of benefits provided by such categorization, as well as strong inputs on how to efficiently segment their spend portfolio.

Better Strategic Planning

For starters, proper spend portfolio segmentation can assist with effective strategic planning across the board. When both supply chain managers and other executives see how different spending patterns or purchased commodities affect the bottom line, they can adjust spending habits to bring their costs more in line with their organization’s greater strategic vision.

Greater Understanding of Funds Allotment

Similarly, procurement managers will have a much-improved understanding of where funds are typically allotted. This is the first step for supply chain cost improvement.

Cost Savings

Good portfolio segmentation and categorization can lead to significant cost savings for organizations. For example, an organization’s supply chain manager may find that the company is spending too much on basic commodities, such as metals for manufacturing. Not only are these metals taking up space in storehouses, but they’re also purchasing far more than they need to meet production quotas.

Costs could be saved by decreasing metals purchasing from raw material suppliers, boosting profits on a per-unit basis.

Increase Sales and Profitability

Naturally, cost savings also lead to increased sales and greater profitability overall. When each unit of a product requires less money to produce, the company will earn more revenue provided that the price doesn't change.

In the long term, smart spending portfolio segmentation can lead to greater profitability across the entire company, not just in a single sector or with a single product’s manufacturing process.

Now that we have acknowledged the main benefits of segmenting the spend portfolio, how does it operationally work?

How to Segment the Spend Portfolio

Segmenting an organization’s spend portfolio is best done through leveraging intelligent supply chain management software like Ravacan and a basic purchasing model called the Kraljic Portfolio Purchasing Model.

This model can help company purchasers maximize their supply chain security and reduce costs, increasing purchasing efficiency.

Supplier Segmentation Matrix

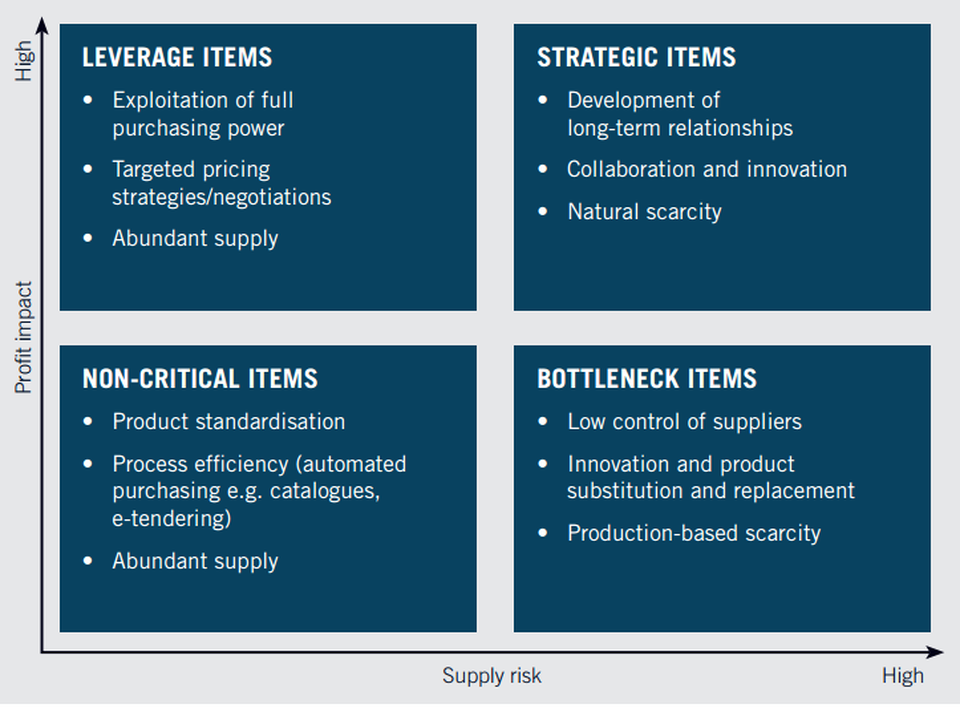

Supply chain managers must first create the supplier segmentation matrix, a box of four quadrants aligned along an x-y axis. The x-axis defines supply risk or volatility while the y-axis defines profit impact the bottom line. In this context, supply risk may be high when the item or category in question is a scarce material or commodity, such as rare metals.

Source: Kraljic matrix (Forbes, 2017)

Along the same lines, a high-profit item may add significant value to supply chain output and overall company bottom-line results.

Define Categories

Supply chain managers should define the categories they want to gather data on. These can include:

Strategic items, which are high-profit impact and high supply risk. These usually get the most attention from supply chain managers. Smart purchasing involves developing robust and long-term supplier relationships and managing any available risks carefully.

Leverage items, which are high-profit impact and low supply risk. Smart purchasing involves buying a lot of given items to ensure you have enough on hand in case of a shortage or finding product substitutes.

Bottleneck items, which are low-profit impact and high supply risk. Smart purchasing strategies involve purchasing more than is necessary of an item when it is available to prevent shortages or finding new ways to control vendors.

Non-critical items, which are low-profit impact and low supply risk. Smart purchasing involves optimizing inventory levels to prevent over-storage, thus raising company costs.

Each category requires different purchasing approaches to maintain portfolio profitability and security.

Supply chain managers should carefully define which items belong in different categories. Raw materials that are needed for most products, such as metals, plastics, and other resources may be strategic or even bottleneck items.

Commodities such as passives and so-called C-Class parts might be leverage items or non-critical items. It all depends on the organization in question.

To properly define items into their appropriate categories, managers may need to gather data on:

The roles that given commodities or raw goods have in product manufacturing

How much different spend categories cost currently

Etc.

Define the Strategic Vision

Supply chain managers should then define their strategic vision. The broader company strategic vision can dictate purchasing mandates and budget levels, as well as inform supply chain managers about the importance of certain items or raw materials.

This, in turn, can help them categorize different items in the spend portfolio accurately.

Separate Supply Chain Items and Commodities

Once the broader company strategy is established, supply chain managers should act on their categories and segment their supply chain items and commodities appropriately. After this is complete, they can begin purchasing or selling as necessary and balancing the spend portfolio according to their outline.

Consider a Second Matrix and Supply Chain Automation Tools

Supply chain automation tools such as Ravacan can help supply chain managers to automate certain tasks and collaborate with suppliers in real-time. Strategic decision-making is easier with software tools on hand since they can accelerate or streamline the process of spend portfolio categorization and data collection.

More advanced spend portfolio segmentation tactics involve creating a secondary matrix for further categorization. This second portfolio matrix should be used to analyze the relationships between suppliers and purchasers.

Strong supplier relationships can lead to steady supplies for raw materials and commodities alike. Weak relationships are more susceptible to volatility in times of economic crisis.

Summary

Ultimately, segmenting an organization’s spending portfolio into different categories or commodities can lead to sweeping savings across the board and result in much greater profits due to more efficient purchasing. All supply chain managers should seek to use the Kraljic Portfolio Purchasing Model alongside automated tools to bolster their purchasing efforts in the future.

Copyright © 2022 Ravacan | All rights reserved